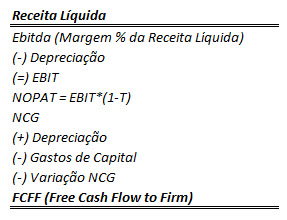

The compound interest calculator online works on the compound interest formula. You will have to input the principal amount, the frequency of compounding, your investment tenure, and the expected rate of return. The compound interest calculator displays the results as the maturity amount at the end of investment tenure. The frequency of compounding varies based on the scheme offered by the bank or financial institutions.

Compound Interest Formula

A compound interest calculator is an advanced mathematical calculator that helps you calculate the return on your investments if compounded periodically. The calculation for compound interest differs from that of simple interest. The calculation for compound interest is more technical as compared to simple interest. In compound interest, the return calculated is on the principal plus the previous interest earned.

Term Insurance

Power of compounding enables your earnings to grow as your investments grow. An interest is added on the initial investment (principal amount), this interest is the compound interest. The power of compound interest lies in reinvesting your returns, allowing your money to grow exponentially over time.

What are Bond Yields?

Compound interest is the eighth wonder of the world, as famously quoted by Albert Einstein. This is because compound interest allows you to earn interest on the interest you’ve already earned. It’s like a snowball effect, where your investment grows larger and larger over time. In India, compound interest plays a significant role in many investment options, such as fixed deposits, mutual funds, and recurring deposits. It can be easy to overlook compounding frequency when choosing things like bank accounts or loans, but it can make a big difference.

Human Life Value Calculator

You can use a power of compounding calculator as many times as you want. It’s a tool designed to help you understand the power of compounding interest. The inputs required to use a compound interest calculator are the initial investment, interest rate, andtime period.

Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. https://www.intuit-payroll.org/statement-of-stockholders-equity-explained/ The company is known for its strong dividend yield and consistent payout history. With a forward dividend yield of 7.28% and 25 consecutive years of dividend growth, Enterprise Products Partners is worth considering. Compared to the compounding scenario, where it took only 10 years to double your money, the simple interest scenario requires an additional four years to achieve the same goal.

But in compounding this happens automatically with no extra effort needed. Let the magic of compounding work for you by investing regularly and staying invested for long horizons and increasing the frequency of loan payments. By familiarizing yourself with such concepts you can make better financial decisions and earn higher returns.

- This can also be called the annual effective rate, and you can use an effective annual rate (EAR) calculator to find out what yours is.

- For example, over the same period, the compound interest accrued on Rs. 1,000 compounded at 10% annually will be less than that on Rs. 1,000 compounded at 5% semi-annually.

- With a forward dividend yield of 7.28% and 25 consecutive years of dividend growth, Enterprise Products Partners is worth considering.

- By familiarizing yourself with such concepts you can make better financial decisions and earn higher returns.

The premium paid towards the ULIP is invested in the market, and the returns earned are compounded. The returns on ULIPs are applications of marginal cost not fixed and depend on the performance of the market. ULIPs are considered to be high-risk, high-return investment options.

When you put your money in a savings account, the bank pays you interest on that money. For example, if you deposit 100 at 5% interest, then at the end of the year, you would have 105 in your account–100 of your https://www.quick-bookkeeping.net/ original money, plus 5 in interest. Although you can use the mathematical formula to determine compound interest, there is always a possibility of committing manual mistakes, which can highly alter the results.

In our article about the compound interest formula, we go through the process ofhow to use the formula step-by-step, and give some real-world examples of how to use it. The return from compounding is higher than that of simple interest. There are several benefits of using a compound interest calculator in India. Please note that by submitting the above mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020.

The TWR figure represents the cumulative growth rate of your investment. It is calculated by breaking out each period’s growth individually to remove the effects of any additional deposits and withdrawals. These example calculations assume a fixed percentage yearly interest rate.